Startup Loans vs. Angel Investment: Which Should You Choose?

When embarking on the exciting journey of building a startup, one of the most crucial decisions you’ll face is how to secure funding.two popular options for entrepreneurs are startup loans and angel investment. But how do you choose the right one for your business? In this detailed guide, we will explore both funding avenues, their advantages and disadvantages, and help you make an informed choice.

Understanding Startup Loans

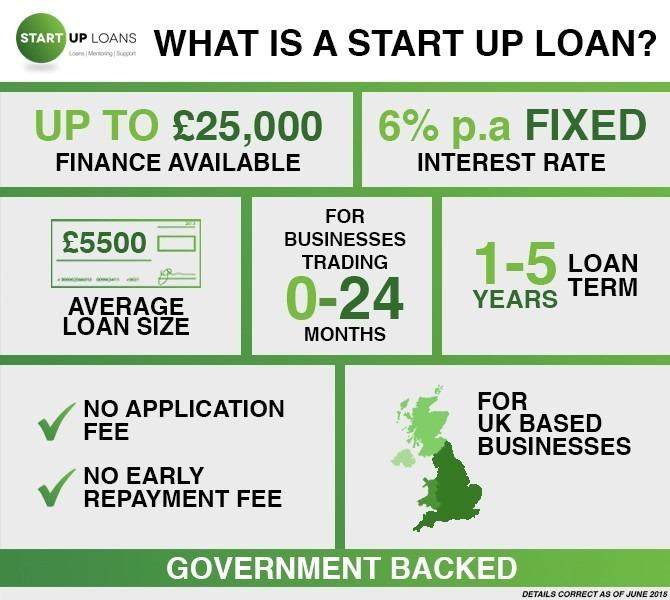

Startup loans are a type of debt financing traditionally offered by banks and financial institutions. They are designed specifically for new businesses that need capital to launch or expand operations. Hear are the key features:

Advantages of Startup Loans

- Maintain Ownership: Unlike equity financing, loans do not require giving up ownership stakes in your business.

- Predictable Repayment: Loan terms are usually fixed, meaning you know exactly how much you need to repay each month.

- Build Credit: Timely repayments help in building your business credit score, which can be beneficial for future financing.

Disadvantages of Startup Loans

- Debt Obligations: You are obligated to repay the loan regardless of your business’s success.

- Interest Payments: Loans come with interest rates that can increase overall costs.

- Strict Qualification Criteria: Obtaining a loan can be arduous for startups lacking strong credit history or collateral.

Exploring Angel Investment

Angel investors are high-net-worth individuals who provide capital to startups in exchange for equity or convertible debt. They frequently enough bring valuable experience and connections to the table. Let’s delve deeper:

Advantages of Angel Investment

- Access to Capital: Angel investors can provide significant funding that might be hard to secure through conventional loans.

- Networking Opportunities: many angel investors offer mentorship and access to their professional networks.

- Less Pressure: Unlike loans, you’re not required to repay the investment instantly, which allows for more flexibility.

Disadvantages of Angel Investment

- Loss of Control: Accepting funding involves giving up a percentage of ownership, which can dilute your decision-making power.

- Investor Expectations: Angels may have expectations regarding your business’s direction and growth, which could create tension.

- longer Process: Finding the right angel investor can take time and effort, and negotiations might potentially be complex.

comparative analysis: Startup Loans vs.Angel Investment

| Feature | Startup Loans | Angel Investment |

|---|---|---|

| Ownership | No dilution | Dilution of equity |

| Repayment obligation | Yes | No immediate obligation |

| Access to mentorship | No | Yes |

| Qualification criteria | Strict | more flexible |

| Cost | Interest rates apply | Equity stake |

Practical Tips for Choosing the Right Funding Option

Assess Your Business Needs

Before making a decision, evaluate your startup’s financial needs. Consider factors such as the amount of capital required, how quickly you need funding, and your growth projections.

Understand Your Comfort Level

Are you agreeable with debt? Do you prefer having full control over your company? Gauge your comfort level regarding financial risk and ownership before proceeding.

Network,Research,and Prepare

If you lean towards angel investment,begin networking early.Attend startup events and pitch competitions to meet potential investors. For loans, research potential lenders and prepare your business plan with financial projections to impress them.

Case Study: Real-Life Examples

Startup Loan Success: Example Co.

Example Co. launched with a startup loan of $50,000. The founders used the funds to build their product and cover marketing expenses, allowing them to break even within a year without diluting ownership.

Angel Investment Success: InnovateTech

InnovateTech raised $250,000 from an angel investor specializing in technology startups.The investor’s guidance and industry contacts helped InnovateTech accelerate their growth trajectory, leading them to a successful acquisition within three years.

Conclusion

Choosing between startup loans and angel investment ultimately depends on your individual needs and business goals. Startup loans offer a great way to maintain ownership and create financial discipline,while angel investment provides valuable mentorship and networking opportunities. Carefully weigh the advantages and disadvantages of each option, tailor your decision to your unique circumstances, and you will be well on your way to securing the best funding for your startup.