As we step into 2025, the economic landscape continues to evolve, presenting both challenges and opportunities for individuals seeking financial relief. For many, the journey toward rebuilding credit can feel daunting, especially when unexpected expenses arise. The good news is that personal loans tailored for those with bad credit can serve as a vital lifeline. In this article, we will explore the top personal loan options available this year, offering insights and guidance to help you navigate the path toward financial recovery. Whether you’re addressing pressing bills,consolidating debt,or financing a much-needed purchase,finding the right loan can empower you to take control of your financial future,irrespective of your credit history. Join us as we uncover the best personal loan solutions to ease your worries and support your aspirations in 2025.

Understanding Bad Credit and Its Impact on Loan Eligibility

Bad credit can often feel like a heavy weight on one’s financial situation, making it challenging to secure loans when needed most. Lenders typically assess an applicant’s credit score as a primary indicator of risk; thus, a lower score can lead to higher interest rates or outright denial of loan applications. Understanding how credit scores are calculated and their implications can empower individuals to take essential steps toward rehabilitation. Some key factors that contribute to a credit score include:

- Payment history – Timely payments boost your score, while missed payments can lead to significant drops.

- Credit utilization – Keeping balances low relative to credit limits helps maintain a healthier score.

- Length of credit history – The longer your accounts have been open, the more positively it can impact your score.

As you navigate the options available in 2025 for personal loans tailored for those with bad credit, it’s important to know that many alternative lenders are increasingly willing to provide assistance. Some even focus on a holistic assessment of an applicant’s financial history rather than solely relying on credit scores. Below is a simple comparison of potential loan options you may encounter:

| Lender Type | Interest Rate Range | Loan Amounts |

|---|---|---|

| Traditional Banks | 5% – 15% | $1,000 – $50,000 |

| Credit Unions | 6% – 12% | $500 – $30,000 |

| Online lenders | 10% – 36% | $1,000 – $50,000 |

| Peer-to-Peer Lending | 8% – 25% | $1,000 - $35,000 |

Exploring Alternative Lenders for Personalized Solutions

As the landscape of personal finance continues to evolve, alternative lenders have emerged as a vital source of support for individuals grappling with bad credit. Unlike traditional banks, thes lenders frequently enough prioritize personalized solutions, catering to the unique financial situations of borrowers. by leveraging innovative technology and alternative data sources, they can assess creditworthiness beyond just a credit score. This approach enables individuals to secure personal loans tailored to their specific needs, fostering financial inclusivity.

When considering alternative lending options, it’s essential to evaluate various factors to find the best fit. Here are some key elements to take into account when exploring these lenders:

- Interest Rates: Compare rates among different lenders to find the most favorable terms.

- loan Amounts: Assess if the lender provides loans in your desired range.

- Repayment Terms: Examine the flexibility in repayment schedules that suit your financial situation.

- Customer Reviews: Look for feedback from previous borrowers to gauge the lender’s reputation.

Additionally, some alternative lenders offering personal loans for bad credit might provide unique features that traditional banks may lack. Consider the table below highlighting a few popular lenders and their standout offerings:

| Lender | Loan Amount | APR Range | Key Features |

|---|---|---|---|

| Lender A | $1,000 – $35,000 | 5.99% – 35.99% | Fast approval, flexible terms |

| Lender B | $500 - $25,000 | 6.99% – 29.99% | No prepayment penalties |

| Lender C | $1,500 – $30,000 | 7.99% – 31.99% | Same-day funding options |

Comparing Interest Rates and Terms for the Best Fit

When evaluating personal loans, understanding interest rates and terms is crucial for making an informed decision, especially for individuals seeking relief from bad credit.Lenders often offer varying rates based on your credit history, loan amount, and repayment timeline. It’s essential to compare these factors to pinpoint the most financially viable option. Key considerations include:

- Annual Percentage Rate (APR): This reflects the true cost of the loan, incorporating the interest and any fees.

- Loan Terms: These can range from a few months to several years, affecting the total interest paid over the loan’s lifetime.

- Fixed vs. Variable Rates: Fixed rates maintain consistency, whereas variable rates may fluctuate, impacting monthly payments.

Comparing multiple lenders side by side can illuminate the best fit for your financial situation. Consider setting up a simple table to summarize your findings:

| lender | APR | Loan Term | Monthly Payment |

|---|---|---|---|

| Lender A | 15.5% | 36 months | $317 |

| Lender B | 18.0% | 24 months | $500 |

| Lender C | 14.0% | 48 months | $250 |

Crafting a personalized spreadsheet can help weigh your options effectively. By inputting crucial figures,you can visualize the overall cost and make a decision tailored to your budget and repayment capacity.

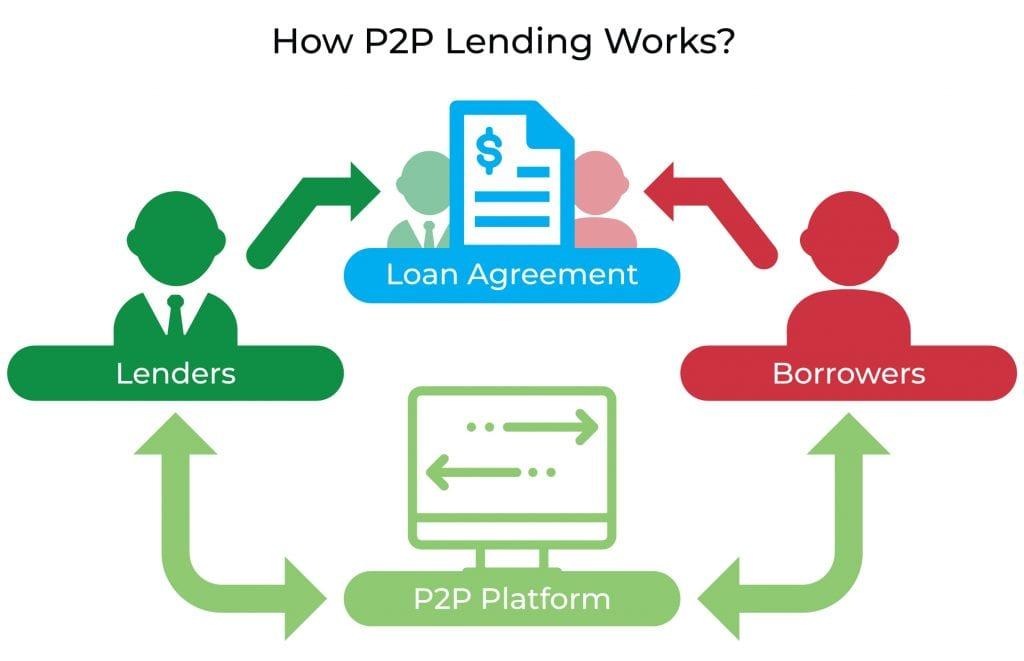

Utilizing Peer-to-Peer Lending platforms for Flexible Options

Peer-to-peer lending platforms have emerged as a vibrant alternative for individuals looking to secure personal loans, especially those with less-than-perfect credit. These platforms connect borrowers directly with individual lenders, often resulting in more competitive interest rates and terms compared to traditional financial institutions. By leveraging technology, P2P lending facilitates faster approvals and greater flexibility, catering to your unique financial needs. Borrowers can explore options tailored to suit their circumstances, offering a refreshing change from the rigid requirements set by conventional lenders.

When considering peer-to-peer lending, it’s essential to compare different platforms based on several key factors:

- Interest Rates: Explore varying rates offered by multiple lenders to secure the best deal.

- Loan Amounts: Determine the range of amounts available to ensure it meets your needs.

- Repayment Terms: Check for flexibility in repayment options that align with your budget and cash flow.

- Fees: Be aware of any associated fees, as they can impact the overall cost of the loan.

Below is a simple comparison of a few popular peer-to-peer lending platforms:

| Platform | Average APR | Loan Range |

|---|---|---|

| LendingClub | 10.68% – 35.89% | $1,000 - $40,000 |

| Prosper | 7.95% – 35.99% | $2,000 – $40,000 |

| Upstart | 8.76% – 35.99% | $1,000 – $50,000 |

By exploring these platforms and considering the listed factors, you can navigate the lending landscape more efficiently, ensuring you find a suitable option that accommodates your financial situation while working toward credit relief.

Strategies for Improving Your Credit While Borrowing

Improving your credit while borrowing may seem like a daunting challenge, but with strategic planning, it can become a manageable process. To begin, consider making timely payments on any loans or credit lines that you take out. Even a single missed payment can negatively affect your credit score,so set up automatic payments or reminders. Additionally, monitor your credit utilization ratio—aim to use no more than 30% of your available credit. Lowering your debt-to-credit ratio can substantially bolster your credit score, making you a more attractive borrower in the future.

Another effective strategy is to limit the number of new credit applications you submit. Each time you apply for credit, a hard inquiry is made, wich can temporarily lower your score.Instead, focus on establishing a solid history of borrowing responsibly.Building a diverse range of credit types—such as a small personal loan and a secured credit card—can demonstrate your ability to manage different kinds of debt. Moreover, consider becoming an authorized user on a responsible person’s credit account, which can help you benefit from their good credit history without the risks associated with traditional borrowing.

Key Considerations for Responsible Borrowing in 2025

As the financial landscape evolves in 2025, being a responsible borrower is paramount, especially for those seeking personal loans with bad credit. The first consideration is understanding your financial position. Before committing to any loan, assess your current income, expenses, and existing debts. This self-evaluation not only helps determine how much you can afford to borrow but also establishes a realistic repayment plan that won’t strain your financial situation. Utilize budgeting tools or apps to track your cash flow effectively.

Additionally, consider the total cost of the loan, including interest rates and any associated fees. these can significantly impact your repayment journey and should align with your long-term financial goals.

Another essential aspect is researching potential lenders. In 2025, more lending institutions are utilizing technology to offer tailored solutions for bad credit borrowers.When comparing options, keep an eye out for reputable lenders who provide transparent terms and customer-pleasant policies. Make sure to check the following before making a decision:

– Interest rates

– Loan terms

– Additional fees

– customer reviews

| Lender | Interest Rate | Loan Amount |

|---|---|---|

| Lender A | 8.5% | $1,000 – $15,000 |

| Lender B | 10.2% | $2,500 – $20,000 |

| Lender C | 9.0% | $1,500 – $10,000 |

Closing Remarks

As we stand on the brink of 2025, the landscape of personal finance continues to evolve, presenting both challenges and opportunities for those with less-than-perfect credit. Navigating this terrain may seem daunting, but with the right strategies and resources at your disposal, achieving financial relief is within reach. The personal loans we’ve highlighted can serve as stepping stones toward rebuilding your credit and regaining financial stability.Remember that a loan is not merely a solution but a means to an end—an prospect to invest in your future. As you consider your options, take the time to research, compare terms, and understand the implications of each choice. With careful planning and a commitment to responsible borrowing, you can harness the power of these financial tools to pave your way to recovery and growth.In today’s ever-changing economic climate, remaining informed and proactive is essential. Armed with the insights shared in this article, you are better equipped to navigate the winding roads of bad credit, fostering resilience and hope for a brighter financial future.Welcome 2025 with confidence, ready to write your own success story!