invoice Financing vs. Business Loans: What’s Better for Cash Flow?

When managing a business, access to cash flow is frequently enough the lifeline to maintaining operations and making strategic moves. Among the myriad of financial options available, invoice financing and business loans stand out as two popular methods for improving cash flow.But how do they compare? In this comprehensive guide, we will dive deep into the pros and cons of each option, helping you make an informed decision tailored to your business needs.

What is Invoice Financing?

Invoice financing is a financial arrangement where a business uses its outstanding invoices to secure cash quickly. In this scenario, businesses can receive advances on their unpaid invoices, thus improving liquidity without having to wait for customers to pay. There are two main types of invoice financing:

- Invoice Factoring: Involves selling receivables to a factoring company, which takes responsibility for collecting the payment.

- Invoice Discounting: Allows businesses to retain control over their invoices and collect payments themselves while borrowing against the invoice amount.

What are Business Loans?

A business loan is a sum of money borrowed from a financial institution or lender specifically for business purposes. The borrowed amount is typically repaid in installments, along with interest, over a designated period. Business loans can come in various forms, such as:

- Term Loans: A lump sum paid back over a fixed schedule.

- Lines of Credit: Flexible borrowing against a set limit.

- SBA Loans: Loans guaranteed by the Small Business Management with favorable terms.

Key Differences: Invoice Financing vs. business Loans

| Criteria | Invoice Financing | business Loans |

|---|---|---|

| Speed of Access | Fast (ofen within 24 hours) | Moderate (typically days to weeks) |

| Request Complexity | Simple (fewer requirements) | Complex (detailed paperwork and credit checks) |

| Impact on Cash Flow | Immediate boost | Predictable cash flow through regular repayments |

| Control Over Invoices | Factor-led or business-led | Full control |

| Repayment Structure | Varies (based on sales) | Fixed installments |

Benefits of Invoice Financing

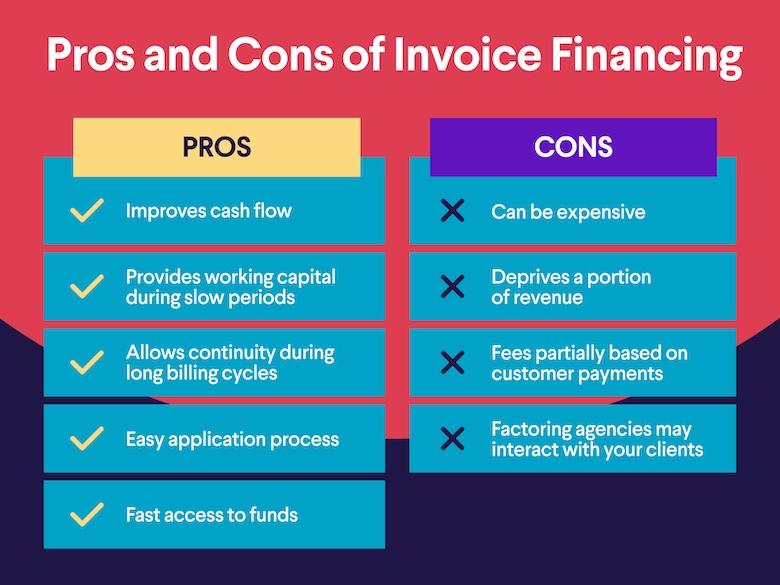

Invoice financing offers numerous advantages, particularly for businesses closely tied to customer payment cycles. Here are some key benefits:

- Improved Cash Flow: Quickly access funds without waiting for invoice payments, helping to meet urgent operational costs.

- No additional Debt: Since it is based on existing invoices, it doesn’t add to your long-term debt burden.

- Credit Adaptability: Less stringent credit requirements compared to traditional loans.

Benefits of Business Loans

On the othre hand,business loans come with distinct advantages as well:

- Asset Acquisition: suitable for purchasing equipment,property,or making long-term investments.

- Fixed Financial Planning: Fixed repayment schedules allow for predictable budgeting.

- Established Relationships: Building a good standing with lenders can lead to better terms in future financing.

Which is Better for Your Business?

The choice between invoice financing and business loans largely depends on your business’s unique circumstances.Here are a few factors to consider:

- Cash Flow Needs: If you need immediate cash to cover operational costs, invoice financing may be more suitable.

- Project Goals: For larger investments in assets or expansion, business loans are often better.

- Credit Status: Businesses with weaker credit may find invoice financing more accessible.

Practical Tips for Choosing the Right Option

Here are some practical tips to help you choose the best financial option for your business:

- Assess your cash flow needs: Evaluate how quickly you need cash and for what purpose.

- Consider the cost: Compare fees and interest rates associated with each option.

- Consult with a financial advisor: Get professional guidance tailored to your business circumstances.

Case Studies: real-Life Experiences

To illustrate the effectiveness of invoice financing and business loans, consider the following case studies:

Case Study 1: A Marketing Agency

- The agency faced cash flow problems during a lengthy client payment period.

- They opted for invoice factoring, receiving 80% of invoice value in just 24 hours.

- This enabled them to pay employees on time and continue operations seamlessly.

Case Study 2: A Construction Firm

- The firm needed to purchase new equipment worth $50,000.

- They took a business loan with a fixed interest rate, spreading the payment over five years.

- This allowed them to make the investment without immediate cash constraints.

Conclusion

Both invoice financing and business loans are viable options for enhancing cash flow, but their suitability varies based on the specific needs and circumstances of your business. Invoice financing can be an excellent short-term solution for immediate cash flow needs,while business loans are preferable for larger investments or equipment purchases. By understanding the unique benefits and drawbacks of each, you can make a well-informed decision that paves the way for your business’s success.