How to Consolidate Multiple Student Loans Effectively

Managing multiple student loans can be overwhelming.If you’re juggling several loan payments every month, consolidation might be the solution you’re looking for. This guide will explore how to consolidate multiple student loans effectively, provide practical tips, and discuss the benefits of student loan consolidation.

What is Student Loan Consolidation?

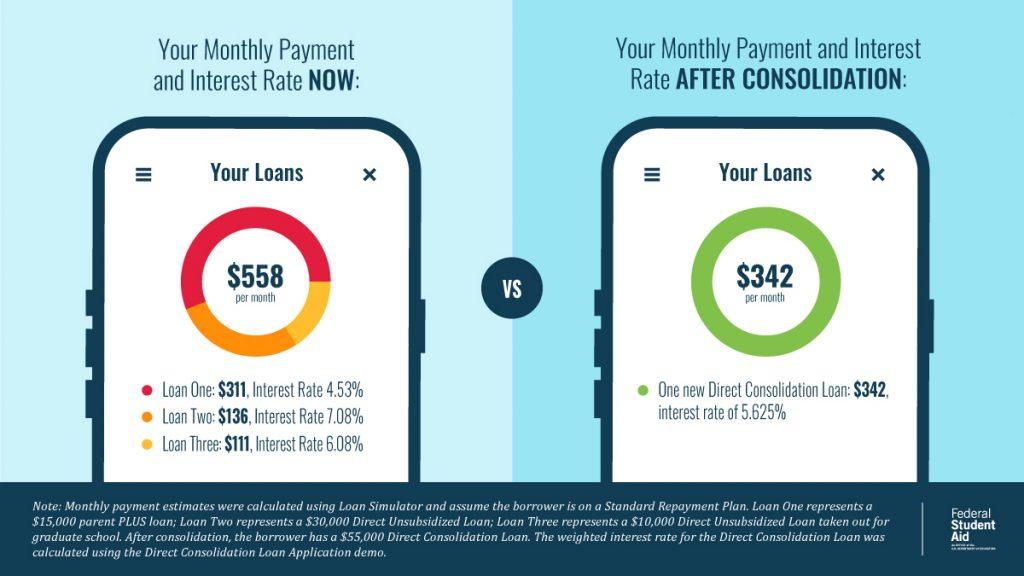

Student loan consolidation is the process of combining multiple student loans into a single loan with one monthly payment. This can simplify your finances and possibly lower your interest rate, depending on the types of loans you have.

types of Student Loan Consolidation

There are two main types of student loan consolidation:

- Federal Loan consolidation: Offered by the U.S. department of Education, this allows you to combine federal student loans into a Direct Consolidation Loan.

- Private Loan Consolidation: Provided by private lenders, this allows you to consolidate both federal and private loans into one private loan.

Benefits of Consolidating student Loans

Consolidating your student loans comes with several benefits, including:

- Simplified Payments: One payment means less stress and better association.

- Lower Interest Rate: You might receive a lower interest rate based on your credit score and financial history.

- Extended Repayment terms: You may have the option to extend the repayment period, lowering monthly payments.

- Access to Additional Repayment Plans: Federal consolidation gives you access to various repayment plans, including income-driven repayment options.

how to Consolidate Multiple Student Loans: Step-by-Step Guide

Step 1: Assess Your Current Loans

Start by making a list of all your student loans, including the lender name, balance, interest rates, and repayment terms. This will give you a clear picture of your current financial situation.

Step 2: Check Eligibility

Determine if you’re eligible to consolidate. For federal loans, visit the Federal student Aid website to learn about eligibility criteria. for private loans,contact your lender for their specific requirements.

Step 3: Research Consolidation Options

Consider both federal and private consolidation options. compare interest rates,fees,and benefits. Keep the following in mind:

| Factor | Federal Consolidation | Private Consolidation |

|---|---|---|

| Interest Rate | weighted average of old loans | Variable rates based on credit |

| Loan Types | Only federal loans | Federal and private loans |

| Repayment Plans | Flexible plans available | options vary by lender |

Step 4: Apply for Consolidation

Fill out the application for federal consolidation through the Federal Student Aid website or contact a private lender for their process. Be prepared to provide personal and loan information.

Step 5: Review Loan Agreement

Carefully read the terms of your new loan agreement. look for any fees, interest rate terms, and repayment schedules. Ensure that you understand the implications of consolidation.

Practical Tips for Effective Consolidation

- Consider Your Financial Goals: Know if you prefer lower monthly payments or a shorter repayment period.

- Maintain Good Credit: A higher credit score can lead to better interest rates for private consolidation.

- Don’t Rush: Take time to research different lenders and options.

- Consult a Financial Advisor: If in doubt,consider getting professional advice to navigate the consolidation process.

Case Study: Sarah’s Triumphant Loan Consolidation

Sarah had five student loans totaling $50,000, with varying interest rates averaging 6.5%. After thorough research,she decided to consolidate her federal loans through direct consolidation.Her new loan’s interest rate was set at 6.5%, simplifying her payments into one monthly fee of $500 for 10 years.

This consolidation relieved Sarah’s financial stress and allowed her to focus on her job without juggling multiple payments every month.

First-hand Experience of Loan Consolidation

Many borrowers share their success stories about consolidating student loans.A common theme involves gaining peace of mind and reduced financial stress. As a notable example, john, who consolidated his loans, reported that combining his payments made it much easier to keep track of his finances. He appreciated the adaptability offered by federal consolidation, as he could change repayment plans if needed.

conclusion

Consolidating multiple student loans can be an effective way to regain control over your finances and reduce the stress of managing multiple payments. By understanding the types of consolidation available, assessing your financial situation, and taking actionable steps to consolidate, you can simplify your repayment process. remember to weigh the pros and cons, and don’t hesitate to seek professional advice if needed. With careful planning and execution, you’ll be on your way to a more manageable financial future.