business Line of Credit vs. Term Loan: Which is Right for You?

Determining the right financing option for your business can be a daunting task. With various alternatives available, understanding the differences between a business line of credit and a term loan is crucial. In this article, we’ll dive deep into the features, benefits, and drawbacks of each option, helping you make an informed decision that aligns with your business needs.

Understanding Business Financing Options

What is a Business Line of Credit?

A business line of credit is a flexible funding solution that allows businesses to access funds up to a predetermined limit. it works similarly to a credit card, where you can borrow funds as needed and pay interest only on the amount you utilize.

Main Features of a Business Line of Credit

- Flexible withdrawal: Access funds when you need them without taking the entire loan amount upfront.

- Interest on usage: You only pay interest on the amount borrowed, not the total credit limit.

- Revolving credit: Once you repay the borrowed amount, the credit is available again for future use.

What is a Term Loan?

A term loan provides businesses with a lump sum of money upfront, which is to be paid back in fixed monthly installments over a set period. These loans are typically used for significant purchases or expenditures that can’t be financed through cash flow.

Main Features of a Term Loan

- Lump sum payment: receive a fixed amount of capital at once to invest in business needs.

- Fixed repayment schedule: Payments are made regularly over a specified period,making budgeting easier.

- Set interest rate: The interest rate can be fixed or variable, depending on the lender and the loan terms.

key Differences Between Business Line of Credit and Term Loans

| Feature | Business line of Credit | Term Loan |

|---|---|---|

| Access to Funds | Revolving, as needed | Lump sum upfront |

| Interest Payment | Only on the amount used | On total amount borrowed |

| Repayment Terms | Flexible, depending on usage | Fixed monthly installments |

| Purpose | Short-term expenses, emergencies | Long-term investments, major purchases |

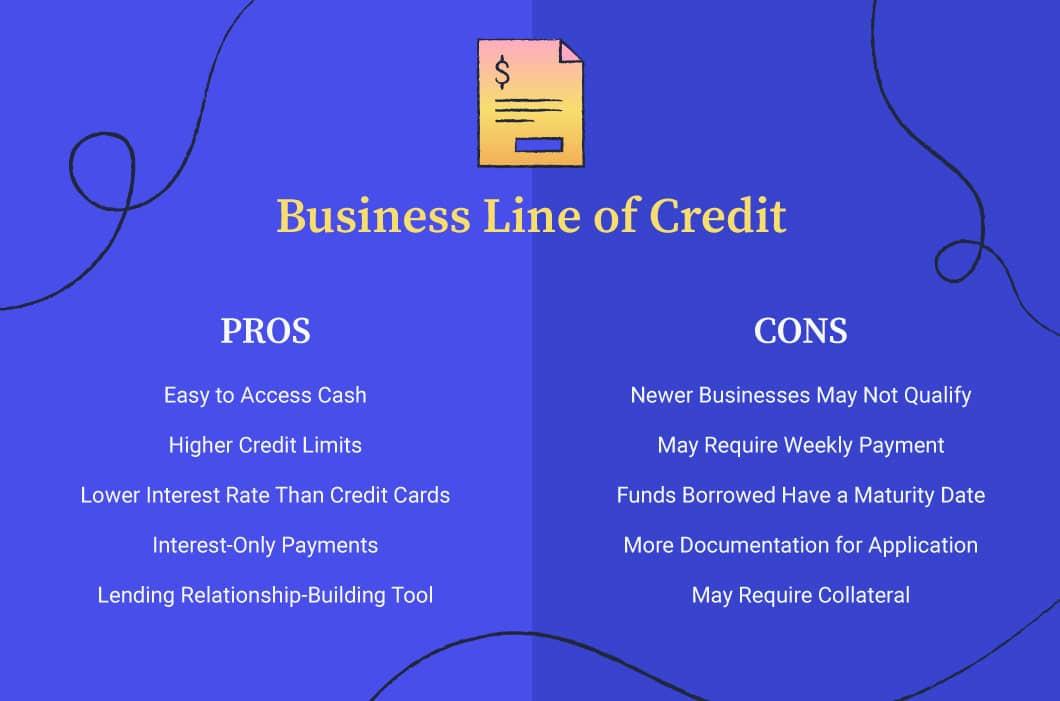

Benefits of Business line of credit

A business line of credit comes with several advantages, including:

- Versatility: Borrow what you need when you need it.

- Fast access to funds: Streamlined submission processes can lead to faster approvals.

- Better cash flow management: Helps businesses manage seasonal fluctuations or unexpected expenses.

Advantages of Term Loans

Term loans also offer several benefits:

- Large capital infusion: Ideal for significant investments, such as equipment or property.

- Predictable payments: Fixed interest rates and repayment schedules make cash flow planning easier.

- Potential tax benefits: Interest payments may be tax-deductible as a business expense.

Choosing the Right Option for Your Business

When deciding between a business line of credit and a term loan, consider the following factors:

- usage: If you need ongoing access to funds for day-to-day operations or immediate cash flow needs, a line of credit may be preferable.

- Purpose: If you’re planning a large purchase or long-term investment,a term loan might be a better fit.

- Repayment Structure: Consider if you prefer the flexibility of a line of credit or the predictability of fixed-term payments.

Case Studies: Real-Life Examples

Business Line of Credit in action

Sarah runs a retail store that sees fluctuating sales during holiday seasons. Using a business line of credit, she can manage inventory purchases during peak times without worrying about cash flow issues.

When a Term Loan Made Sense

John owns a bakery and wanted to expand to a larger location. He opted for a term loan, which provided him with the capital needed to secure the property, renovate it, and purchase new baking equipment.

Practical Tips for Businesses

Before making a decision, consider the following tips:

- Evaluate your financial needs: Assess your current and future funding requirements.

- Review your credit score: Your creditworthiness will determine your eligibility and terms.

- Compare multiple lenders: Shop around for the best interest rates and terms.

Conclusion

Choosing between a business line of credit and a term loan is a pivotal decision for your business’s financial health. While a line of credit offers flexibility for short-term needs, a term loan provides the capital necessary for long-term investments. By carefully assessing your business requirements, you can select the financing option that best aligns with your operational goals. Whether you go for a line of credit or a term loan, understanding the features and benefits of each can significantly impact your business’s success.