What is APR and How Does It Affect yoru Loan Cost?

When it comes to borrowing money, understanding the terms and metrics involved can greatly influence your financial wellness. One critical acronym that you’ll often encounter is APR—or Annual Percentage Rate. This article will explore what APR is,its types,how it impacts the cost of your loans,and practical tips to minimize loan costs.

What Does APR Mean?

APR stands for Annual Percentage Rate. It represents the total cost of borrowing money on an annual basis. Rather than just providing the interest rate,APR takes into consideration various fees and costs associated with the loan.Thus,it offers a more extensive picture of what you’ll owe over the lifespan of the loan.

Types of APR

Understanding the different types of APR can help you navigate loan documents more effectively. Here are the main types:

- Fixed APR: This type maintains the same interest rate throughout the life of the loan, providing predictability in payment schedules.

- Variable APR: This fluctuates based on market conditions, which means your payments can increase or decrease over time.

- Introductory APR: Often used in credit card offers, this is a lower rate that applies for a limited time before reverting to a higher standard rate.

How is APR Calculated?

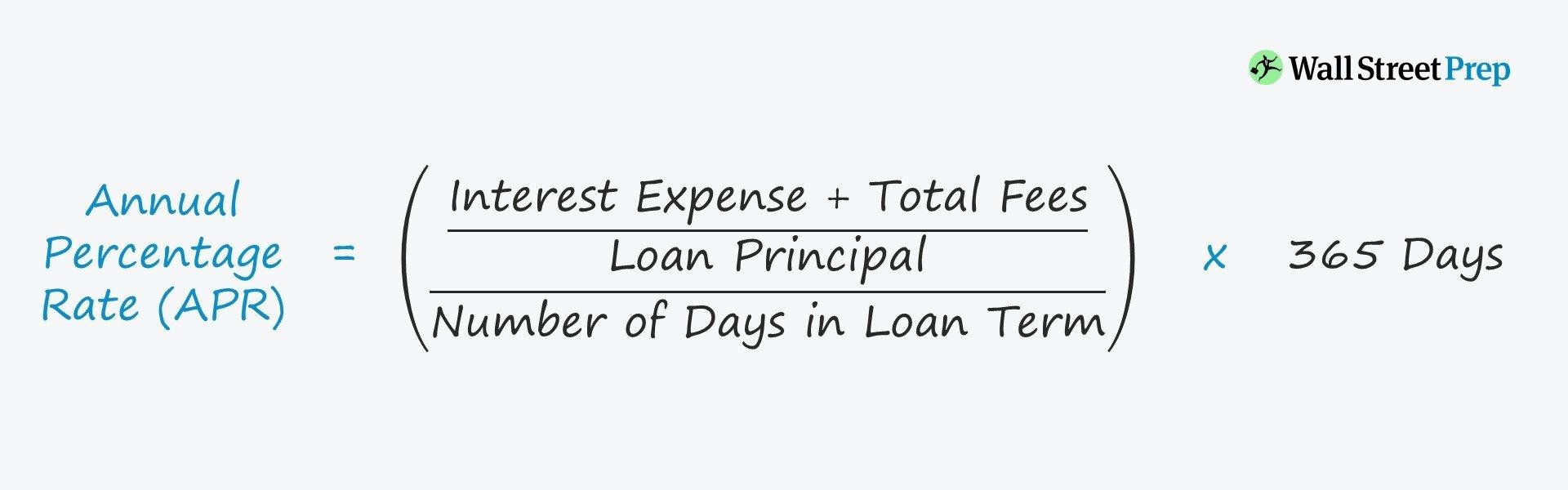

The APR calculation involves a few different components,including the nominal interest rate,any fees (like closing costs or loan origination fees),and the term of the loan. Here’s a simplified formula for calculating APR:

APR = (interest + fees) / Principal

To express this as an annual rate, multiply by the number of periods in a year (i.e., 12 for monthly).It’s worth noting that APR does not account for compounding interest, which is a key difference between it and the nominal interest rate.

The Impact of APR on Loan Cost

APR significantly affects the total cost of your loan. Here are a few ways it can impact what you pay:

- Total Interest Payments: A higher APR directly translates to more interest over the life of the loan, which can dramatically increase repayment amounts.

- Monthly Payments: A higher APR typically leads to higher monthly payments, affecting your cash flow and budget.

- Loan Affordability: Understanding your APR can definitely help in choosing a loan that fits your financial situation best, possibly saving you money in the long run.

Example: APR Comparison

To illustrate the impact of different APRs, consider the following example for a $10,000 loan with a 5-year term:

| APR (%) | Monthly Payment ($) | Total Payments ($) | Total Interest Paid ($) |

|---|---|---|---|

| 3.00 | 179.69 | 10,781.87 | 781.87 |

| 5.00 | 188.71 | 11,322.23 | 1,322.23 |

| 7.00 | 197.73 | 11,866.38 | 1,866.38 |

Benefits of Understanding APR

Having a grasp on APR can yield several benefits:

- Informed Decision-Making: You can compare multiple loan offers more reliably, as APR provides a uniform metric.

- Better Budgeting: By understanding how APR impacts monthly payments, you can prepare your finances more effectively.

- Savings Over Time: Choosing loans with lower APRs avoids costly interest payments.

Practical Tips for Minimizing APR Costs

here are some practical tips to help you lessen the impact of APR on your loans:

- Shop Around: Don’t settle for the first loan offer. Compare APRs from multiple lenders.

- Improve Your Credit Score: A higher credit score frequently enough qualifies you for lower APRs.

- consider the Loan Terms: Sometimes,shorter loan terms can offer lower APRs,saving you on interest.

- Negotiate Fees: Ask lenders about lowering fees that can affect your APR.

Conclusion

Understanding APR and its implications is crucial for anyone looking to borrow money. It provides an essential outlook on loan costs and helps ensure that you make informed financial decisions. By knowing how to calculate APR, its impact on your loans, and the strategies to minimize it, you can save money and manage your financial future effectively. Always have a clear grasp of loan terms before signing on the dotted line, and remember, a little research can help you save a lot in the long run.