How to Avoid Predatory Lenders and Spot Red Flags

In today’s financial landscape, understanding how to avoid predatory lenders is crucial for anyone seeking a loan. Predatory lending practices can trap individuals and families in cycles of debt, often leading to severe financial consequences. This article provides you with the tools you need to identify red flags, avoid predatory lenders, and make informed financial decisions.

What is Predatory Lending?

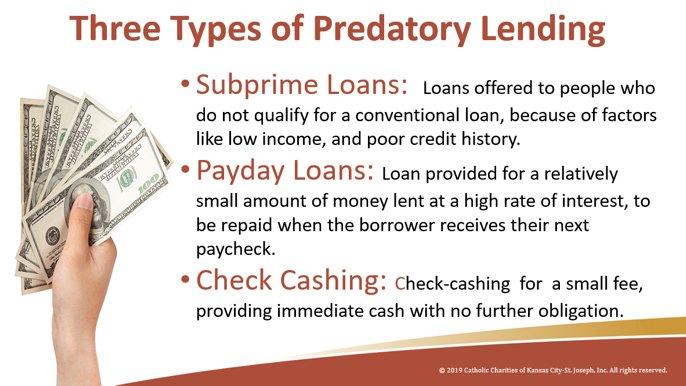

Predatory lending refers to unethical practices by lenders during the loan origination process. These lenders frequently enough target vulnerable borrowers and offer loans with unfair conditions, resulting in excessive fees, high interest rates, and unrealistic repayment plans.

Why You Should Be Concerned About Predatory lenders

- High interest rates can lead to unmanageable debt.

- Unclear terms and high fees can lead to a cycle of refinancing.

- Risk of foreclosure on homes with loans secured against property.

Common Red Flags of Predatory Lending

Knowing the warning signs of predatory lending can definitely help you steer clear of harmful loans. Here are some telling red flags to watch out for:

1. High-Pressure Tactics

Predatory lenders often use aggressive sales techniques to rush you into a decision:

- They may pressure you to accept a loan on the spot.

- warnings about missing “limited-time” offers.

2. Unclear Loan Terms

Watch for complex jargon or terms that are difficult to understand:

- Be wary of long, convoluted contracts.

- Ask for clarification on any terms or conditions.

3. Excessive Fees

Predatory lenders frequently enough tack on hidden fees that significantly increase the overall loan cost:

- Look out for origination fees, processing fees, and othre charges.

- Compare fees with reputable lenders to identify irregularities.

4. Not Reviewing Your Financial Situation

Reliable lenders evaluate your financial health before approving loans:

- Predatory lenders may overlook your credit history or income verification.

- A reputable lender will always assess your ability to repay the loan.

How to Protect Yourself from Predatory Lenders

Protecting yourself from predatory lenders involves due diligence and awareness of your rights as a borrower. Here are some practical tips:

1.research Lenders Thoroughly

Before you apply for a loan, research potential lenders:

- Check online reviews and Better Business Bureau ratings.

- Look for consumer complaints related to predatory practices.

2. Read the Fine Print

Always read the loan agreement carefully, paying close attention to:

- Interest rates and annual percentage rates (APR).

- Fees, penalties, and loan terms.

3. Ask Questions

Don’t hesitate to ask lenders about anything unclear:

- Request breakdowns of all fees and charges.

- Inquire about prepayment penalties and total cost of the loan.

4. Seek Professional Advice

If in doubt, consider consulting a financial advisor or a nonprofit credit counselor:

- A professional can definitely help you understand loan terms better.

- They may offer alternatives that suit your financial situation.

Case Studies: Real-Life Experiences with Predatory lenders

Understanding predatory lending often becomes clearer when observing real-life examples:

| Case study | Predatory Lending Practice | Outcome |

|---|---|---|

| john’s Mortgage | Unnecessarily high interest rate | Foreclosure |

| Maria’s Payday Loan | High fees and rollover loans | Cycled into debt |

| Tom’s Auto loan | Excessive add-on fees | Financial hardship |

Benefits of Avoiding Predatory Lenders

By recognizing predatory lending practices and steering clear of such lenders, you can enjoy several benefits:

- Improved financial stability and peace of mind.

- Greater understanding of your loan terms and better decision-making.

- Avoidance of traps that could lead to more debt.

Conclusion

Knowing how to avoid predatory lenders is an essential skill in today’s financial environment. By recognizing red flags, conducting thorough research, and asking the right questions, you can protect yourself from falling into a cycle of debt. Remember, the key to successful borrowing is informed decision-making. Keep this guide handy as you navigate the world of loans and ensure your financial well-being.