How Your Credit Score Affects Your Student Loan Terms

When it comes to funding your education, understanding how your credit score affects your student loan terms is essential. Having a good credit score can mean the difference between low-interest rates and high monthly payments. In this comprehensive guide, we will explore how your credit score impacts your student loans, the benefits of maintaining a good credit score, and practical tips for improving your creditworthiness.

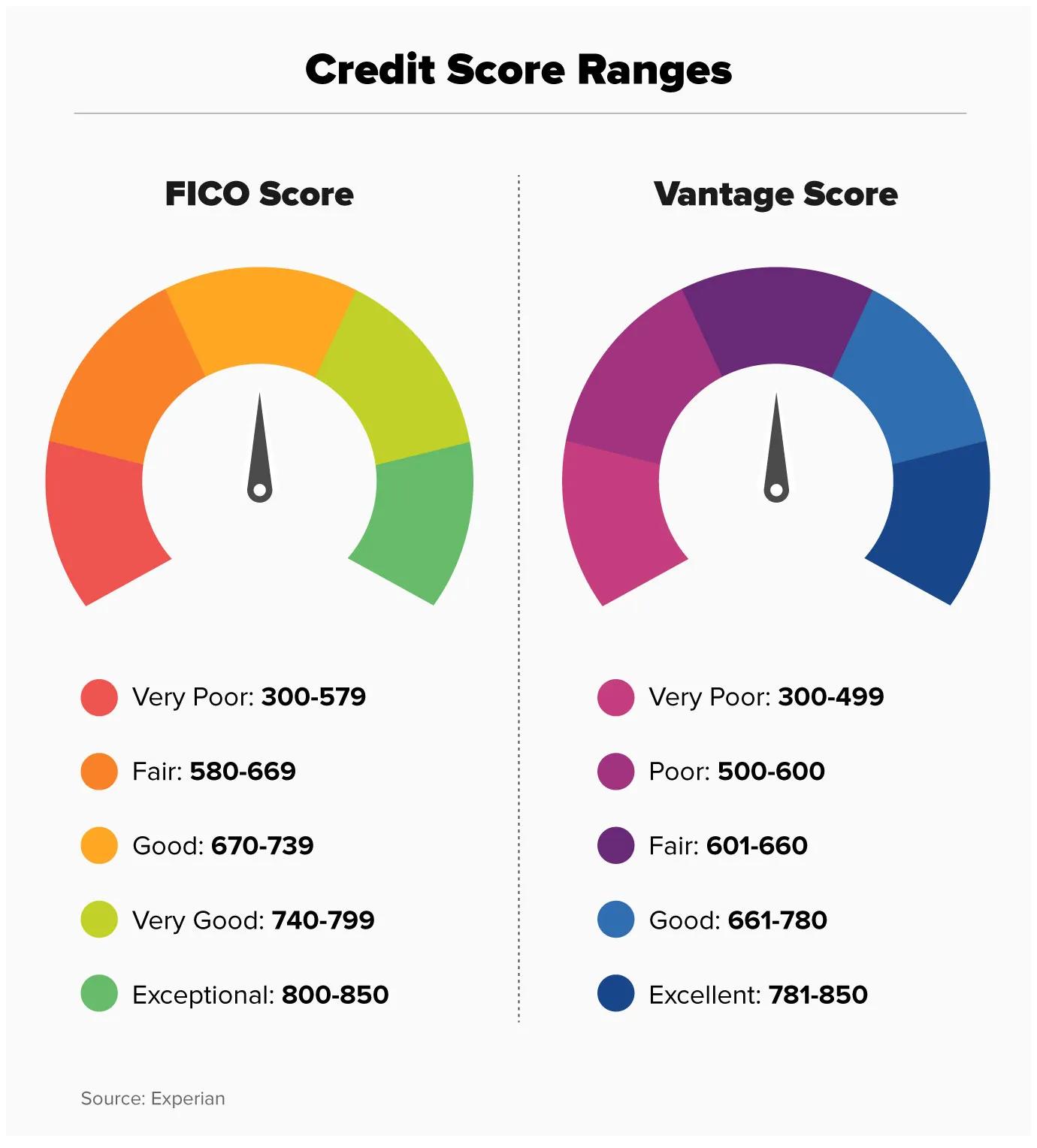

What is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness. Ranging from 300 to 850, your score is resolute by various factors, including:

- Payment History: Timeliness of payments made on credit accounts.

- Credit Utilization: Ratio of current credit balances to available credit limits.

- Length of Credit History: Age of your credit accounts.

- Types of Credit Used: A mix of credit accounts, such as credit cards, mortgages, and auto loans.

- New Credit inquiries: The number of recent credit checks performed.

How Your Credit Score Influences Student Loan Terms

Your credit score plays a critical role in determining the terms of your student loans, including interest rates, loan amounts, and repayment options. Hear’s how:

1. Interest Rates

Private lenders typically use credit scores to set interest rates on student loans. Generally, borrowers with:

| Credit Score Range | Average Interest Rate |

|---|---|

| 300 – 579 | 10% – 12% |

| 580 – 669 | 7% – 9% |

| 670 - 739 | 4% – 6% |

| 740 – 799 | 3% – 5% |

| 800 – 850 | 2% – 4% |

Private loans often come with variable interest rates, which can increase or decrease based on market conditions. A better credit score can provide more options for fixed-rate loans, making your repayment plan more predictable.

2. Loan Amounts

Your credit score can also influence the amount of money a lender is willing to provide. Borrowers with higher scores may qualify for larger loans due to perceived lower risk. This allows for:

- Coverage of full tuition costs.

- Additional funding for living expenses or materials.

3. Repayment Versatility

Higher credit scores may also lead to better repayment options, including:

- Longer repayment terms

- Access to deferment or forbearance options without high penalties

- Eligibility for cosigner release sooner

Benefits of a Good credit Score

A good credit score not only provides more favorable student loan terms but also offers several other benefits:

- Lower Monthly Payments: Easily manageable payments help reduce financial stress.

- Better Loan Offers: Access to a variety of lenders and loan products.

- Future Financial Freedom: Higher credit scores may facilitate car loans,mortgages,and credit cards with attractive benefits.

Practical Tips for Improving Your Credit Score

If you’re looking to improve your credit score before applying for student loans, consider these tips:

- Pay Bills on Time: Timely payment of utilities, credit cards, and other bills positively impacts your credit score.

- Reduce Outstanding Debt: Focus on paying down existing debt to improve your credit utilization ratio.

- Limit New Credit Applications: minimize new credit inquiries to avoid impacting your score.

- Regularly review Your Credit Report: Check for inaccuracies and dispute them to maintain a clean credit history.

Case Study: Real-Life Impact of Credit Scores on Student Loans

To illustrate the impact of credit scores,consider the following case:

Emily,a recent college graduate,had a credit score of 780 when she applied for a private student loan. Consequently, she received an interest rate of 3.5% on her $30,000 loan, leading to monthly payments of approximately $300.

Conversely,Jake,another graduate,had a credit score of 620 and was offered a 10% interest rate on the same loan amount,resulting in monthly payments of around $400.

These differences highlight how a good credit score can save you meaningful amounts over the life of a loan.

First-Hand experience: Navigating Student Loans with a Good Credit Score

As someone who went through the student loan process, I can attest to the importance of a solid credit score.I was lucky to have a score above 750, allowing me to secure a low-interest rate.With careful budgeting during school, I managed my expenses effectively, and by the time I graduated, I had a clear path for repayment without financial burden.

The experience taught me valuable lessons about financial literacy and the importance of maintaining a healthy credit profile.

Conclusion

Your credit score plays a substantial role in determining your student loan terms. Understanding this connection can empower you to make informed decisions about your finances. Maintaining a good credit score not only helps you secure better loan terms but also opens doors to more financial opportunities in the future. With the right strategies and practices, you can enhance your creditworthiness, making your educational journey much smoother.

By prioritizing your credit health today, you lay the foundation for a financially secure tomorrow. So, assess your credit score, implement the tips provided, and take charge of your student loan experience!