In the exhilarating world of entrepreneurship, the journey from concept to launch is often paved wiht challenges that test the resolve and creativity of aspiring founders. Among the most formidable of these challenges is securing the necessary funding to bring a vision to life. Whether it’s turning a groundbreaking idea into a tangible product or laying the groundwork for a transformative service, the pursuit of financial resources is a critical step for every startup. “Unlocking Funds: Your Guide to Securing a Startup Loan” is designed to demystify the loan request process, providing you with the insights and tools needed to navigate the financial landscape confidently. In this guide, we’ll explore the various types of startup loans available, the essential steps to prepare a compelling application, and the strategies to enhance your chances of approval. Join us as we embark on this journey, unlocking the doors to funding and empowering your entrepreneurial dreams.

Understanding the Landscape of Startup Financing

Navigating the world of startup financing can often feel overwhelming, but understanding the various options is essential for building a solid foundation for your venture. Startup loans are a popular avenue for entrepreneurs seeking capital, as they offer tailored financial solutions to meet the unique needs of a nascent business. It’s crucial to recognize that loans come in various forms, each with it’s own requirements and implications. Here are a few common types to consider:

- Term loans: Typically offered bybanks, these loans provide a lump sum amount that must be repaid over a set period, usually with fixed interest rates.

- Lines of Credit: This flexible option allows businesses to draw funds as needed up to a certain limit, paying interest only on the amount used.

- Small Business Administration (SBA) Loans: Backed by the government, these loans generally have lower interest rates and longer repayment terms, but they require thorough documentation and a strong credit history.

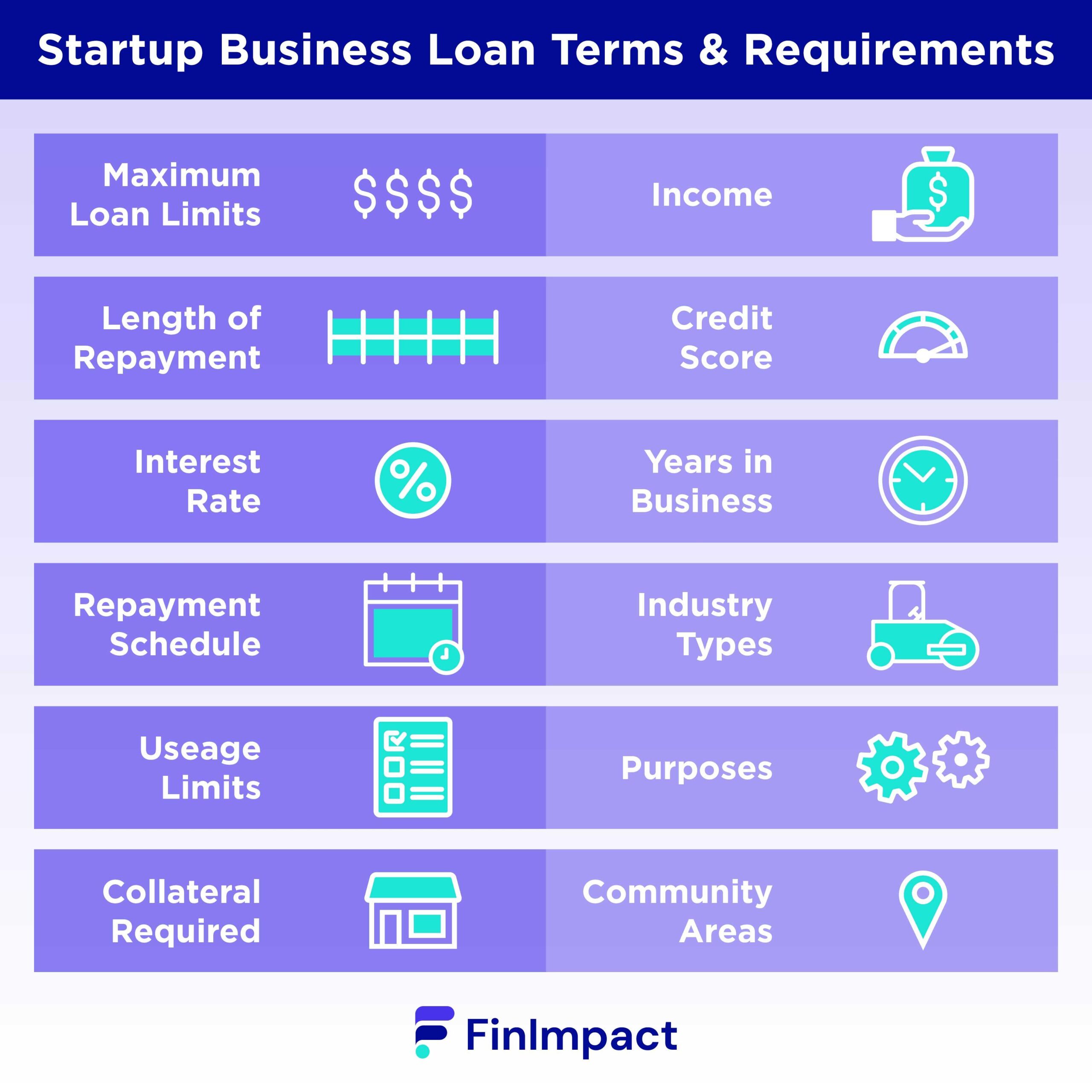

Determining which financing route to take depends on several factors, including your startup’s industry, growth trajectory, and personal financial situation. A well-prepared business plan is essential when approaching lenders, as it outlines your vision and shows how the funds will be utilized effectively. Additionally, consider the following key elements when seeking a loan:

| Element | Description |

|---|---|

| Credit Score | Your personal and business credit scores will considerably impact your loan eligibility. |

| Business Plan | A comprehensive plan showcasing your business model, revenue projections, and market analysis is crucial. |

| Collateral | Many lenders require assets to secure the loan in case of default. |

Identifying Your Funding Needs and Goals

Before diving into the world of startup loans, it’s vital to clarify what you need financially and what you aim to achieve. Understanding your funding needs involves assessing both immediate and long-term expenses. Consider factors such as:

- Startup Costs: Initial investments, equipment, and inventory.

- Operating Expenses: Rent, utilities, and salaries.

- Marketing Budget: Promotional efforts to build your brand.

- Contingency Fund: A cushion for unexpected costs.

Once you establish these figures, set specific goals for what you want to accomplish with the funds.this can include increasing your customer base, launching new products, or breaking even within a certain timeframe. To create a clear picture, you may want to use a financial projection table that outlines your expected revenue, costs, and profitability over time:

| Time period | Projected Revenue | Expected Costs | Net Profit |

|---|---|---|---|

| Q1 | $20,000 | $15,000 | $5,000 |

| Q2 | $25,000 | $18,000 | $7,000 |

| Q3 | $35,000 | $20,000 | $15,000 |

| Q4 | $50,000 | $25,000 | $25,000 |

Exploring Different Types of Startup Loans

When it comes to financing your startup, understanding the various types of loan options available is crucial. Each type of loan caters to different business needs,repayment capacities,and eligibility criteria. Here’s a brief overview of some popular startup loan options:

- conventional bank Loans: These usually come with lower interest rates, but require a strong credit score and solid business plan.

- SBA Loans: Backed by the Small Business Administration, these loans often offer advantageous terms but may involve a lengthy application process.

- Online Lenders: Faster approval and funding, but typically at higher interest rates. Great for those who need quick cash.

- Personal Loans: For new entrepreneurs lacking business credit, personal loans can be an option, though they put personal assets at risk.

- Peer-to-Peer Lending: This involves borrowing money from individual investors through online platforms,often with more flexible terms.

To identify the ideal financing route, entrepreneurs should assess their current financial situation, business model, and long-term goals. Examining the pros and cons of each loan type can aid in making informed decisions. Below is a simplified comparison table of key loan types:

| Loan Type | Interest Rate | Time to Fund | Best For |

|---|---|---|---|

| Traditional Bank Loans | Low | Weeks | Established Businesses |

| SBA Loans | Moderate | Weeks to Months | Small Businesses |

| Online Lenders | High | Days | Quick Cash Needs |

| Personal Loans | Variable | Days | New Entrepreneurs |

| Peer-to-Peer Lending | Variable | Days | Flexible Funding |

Crafting a Compelling Business Plan for Loan Applications

Creating a targeted business plan is essential when you’re seeking a startup loan. This document isn’t just a formality; it’s your opportunity to convey your vision and demonstrate the feasibility of your business model. Key components should include:

- Executive Summary: A concise overview of your business,goals,and why funding is necessary.

- Market Analysis: Insight into your target market, competition, and trends backing your business strategy.

- Financial Projections: detailed forecasts that include profit and loss statements, cash flow analysis, and break-even analysis.

- Business Structure: Clear outline of your business model,operational plan,and management team.

- Funding Request: A specific amount you’re seeking and the intended use of funds,ensuring lenders see the value in backing your venture.

Each section of your business plan should intertwine seamlessly, painting a holistic picture of your business ambitions. Utilize tables to present financial data clearly and professionally. Here’s an example of how to structure your projected financials:

| Year | Projected Revenue | Projected Expenses | Net Profit |

|---|---|---|---|

| Year 1 | $50,000 | $40,000 | $10,000 |

| Year 2 | $75,000 | $50,000 | $25,000 |

| Year 3 | $100,000 | $70,000 | $30,000 |

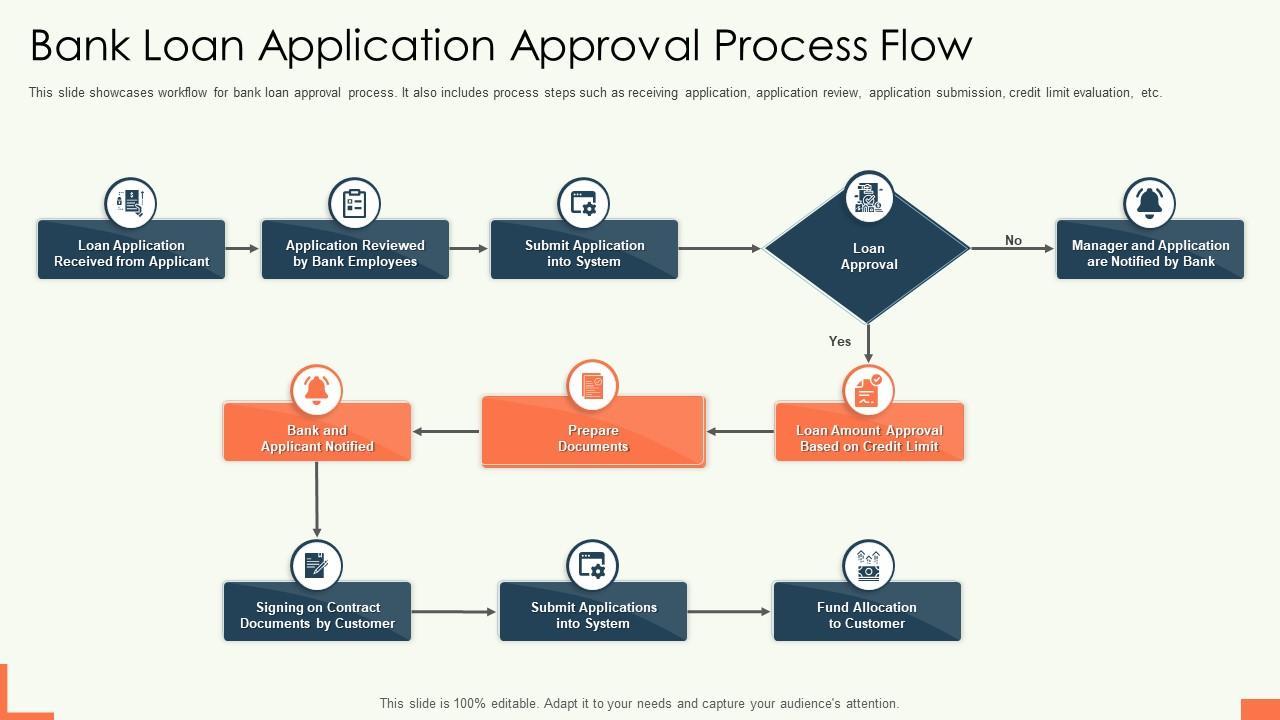

Navigating the Loan Application Process with Confidence

Embarking on the journey to secure a startup loan can feel overwhelming, but with the right readiness, you can approach the process with clarity and reassurance. Start by organizing your financial documents,as these will be crucial in demonstrating your business’s potential. Essential documents to gather include:

- Business plan: Outline your goals, strategies, and how you intend to use the funds.

- Personal and business credit reports: Lenders will assess your creditworthiness.

- Financial statements: Provide a snapshot of your current financial status, including income, expenses, and assets.

When you begin filling out loan applications, ensure you communicate clearly and accurately. many lenders look for specific qualities in an applicant, which can enhance your chances of approval. Here are some key attributes to highlight:

- Strong business model: Clearly articulate how your business will make a profit.

- Competent management team: Showcase your team’s expertise and their ability to navigate challenges.

- Market demand: Illustrate the need for your product or service within your target audience.

| Loan Type | Best For | Key Features |

|---|---|---|

| Microloans | New Entrepreneurs | Small amounts, flexible terms |

| SBA Loans | Established Businesses | Long repayment terms, lower rates |

| Online Lenders | Quick Access to Funds | Fast approval, higher rates |

Building relationships with Lenders for Long-Term Success

Establishing solid connections with lenders is a vital aspect of securing financing for your startup. when you cultivate a relationship built on trust and transparency, it opens doors not only for immediate funding but also for long-term support as your business grows. Start by researching potential lenders thoroughly; understand their lending history, areas of expertise, and the types of businesses they typically finance. This knowledge empowers you to tailor your proposals more effectively and conveys your sincere interest in forming a partnership.

Once you identify suitable lenders, initiate dialogue by attending networking events where you can meet them in person or reaching out via professional platforms like LinkedIn. Aim to build rapport through honest conversations about your business goals and how their support can definitely help achieve them. Focus on the benefits of a strong lender relationship: flexible financing options, valuable advice, and potential introductions to other industry contacts. In the following table, we outline key factors to remember when nurturing these relationships:

| Key Factor | Description |

|---|---|

| Communication | Maintain open lines of communication; keep lenders informed of your business developments. |

| Clarity | Be clear about your funding needs and specific use of funds. |

| Follow-up | Regularly follow-up on their feedback and express appreciation for their guidance. |

| Networking | Participate in events where you can introduce them to your network as well. |

In Conclusion

As we wrap up our exploration of unlocking funds for your startup, it’s clear that the path to securing a loan is multifaceted, requiring diligence, preparation, and an understanding of the financial landscape. Remember, a startup loan isn’t just a lifeline; it’s an opportunity to transform your vision into reality. By following the guidelines outlined in this article, from assessing your financial readiness to navigating lenders’ expectations, you can position yourself for success.As you embark on this journey, keep in mind that every setback can be a stepping stone, and every lesson learned can guide you toward your business goals. Whether you’re in the envisioning stage or ready to pitch your idea, understanding the intricacies of startup financing will empower you to make informed decisions.

With perseverance and the right resources at your disposal, you can unlock the funds needed to fuel your entrepreneurial dreams. So, take a deep breath, gather your insights, and step confidently into the world of startup funding. Your vision awaits; seize the opportunity and transform it into your reality.Happy funding!