In an era where financial flexibility is more crucial than ever, personal loans have emerged as a valuable lifeline for those seeking to manage expenses, consolidate debt, or fund significant life events. However, for many borrowers, teh burden of high-interest rates can turn this lifeline into a heavy anchor. Enter the world of low-interest personal loans—where savvy consumers can discover not only manageable repayment options but also the peace of mind that comes with making informed financial choices. In this article, we embark on a journey through the landscape of personal financing, highlighting the best low-interest personal loan lenders available today. Whether you’re considering your first loan or looking to refinance an existing obligation, we aim to equip you with the knowledge you need to secure a better deal and ultimately take charge of your financial destiny. Join us as we demystify the lending process and unveil the top contenders that can help you achieve your financial goals without sinking under the weight of exorbitant interest rates.

Understanding Low-Interest Personal Loans and Their Benefits

low-interest personal loans offer a viable financial solution for those looking to fund various life expenses without straining their budgets. These loans typically feature lower interest rates compared to traditional personal loans, making them an attractive option for borrowers who prioritize cost-effectiveness. Utilizing a low-interest loan can help individuals finance significant purchases, consolidate debt, or cover unexpected expenses, all while keeping repayment terms manageable.

Moreover, the benefits encompass more than just reduced interest rates. Borrowers can enjoy flexible repayment options, allowing them to choose terms that best fit their financial situation. Additionally, many lenders offer swift approval processes, enabling funds to be accessed rapidly when they’re most needed. Here are some advantages of opting for a low-interest personal loan:

- Lower Monthly Payments: Reduces financial strain.

- Access to Larger Amounts: Borrow more without excessive costs.

- Improved Credit Score: Timely repayments positively impact your score.

Evaluating Lender options: Key Features to Consider

When choosing a lender for your personal loan, it’s crucial to look beyond just interest rates. Think about the loan amount and term flexibility, as some lenders may offer larger sums or more adaptable repayment schedules that suit your financial situation. Additionally, consider the application process; a smooth, straightforward online application can save you time and stress. Look for lenders who allow for quick pre-approval processes, which can give you a clearer picture of what you can expect in terms of loan amounts and rates before diving in.

Moreover, don’t underestimate the importance of customer service and transparency in lender communications. Reading through customer reviews can provide insights into responsiveness and support during the loan process. It’s also advisable to examine the fees and penalties associated with the loan. Hidden fees can significantly impact overall loan costs and might include origination fees or penalties for early repayment. Lastly, check if the lender provides financial education resources to help borrowers make informed decisions through their lending journey.

Top Lenders with Competitive Rates and flexible Terms

When searching for a personal loan, the most competitive lenders often stand out due to their attractive interest rates and adaptable repayment options. Leading the pack, Lender A offers a starting interest rate of just 5.99%, making it an appealing choice for borrowers looking to save on interest payments. Their terms can stretch from 12 to 60 months, allowing for customized repayment plans that align with your financial situation. Lender B, on the other hand, boasts a quick approval process and flexible payment schedules that can be adjusted mid-term. With rates beginning at 6.25%, this lender caters to those who may require a bit more leniency in managing their monthly dues.

For more extensive options, consider checking out the following lenders, each of which has been recognized for providing excellent customer service alongside low-interest rates:

| Creditor | Starting Interest Rate | Loan Range | Repayment Terms |

|---|---|---|---|

| Lender A | 5.99% | $1,000 - $50,000 | 12 – 60 months |

| Lender B | 6.25% | $500 – $40,000 | 24 – 48 months |

| Lender C | 6.99% | $2,000 - $30,000 | 36 – 72 months |

These lenders not only prioritize competitive rates but are also known for their straightforward applications and prompt funding timelines, ensuring your financial needs are met without needless delays. Evaluating these choices not only opens up avenues for robust financial support but also promotes a lending experience that is both obvious and user-amiable.

Customer Experiences: What Borrowers Are Saying

Borrowers have been expressing their satisfaction with various low-interest personal loan lenders, highlighting their overall experiences as pivotal in helping them achieve financial stability. Customers often praise the transparent application process offered by lenders, noting that they appreciated the clarity of the terms outlined before signing on the dotted line. many have commented on the quick approval times, which allowed them to access the funds they needed almost immediately. Some key points frequently mentioned include:

- Responsive Customer Service: A significant number of borrowers felt supported throughout their loan journey by prompt and helpful representatives.

- Flexible Repayment Options: Lenders that offer varied repayment plans were especially applauded, as they help suit individual financial circumstances.

- Low Fees: Many users noted their gratitude for lenders who did not burden them with excessive fees, emphasizing fair practices.

Moreover, countless testimonials showcase how low-interest loans have facilitated life-changing opportunities. Borrowers have shared success stories about using funds for crucial expenses like home repairs or education fees. One lender stood out due to it’s low interest rates combined with personalized customer attention, leading to a satisfying lending experience. The following table summarizes borrower ratings for some notable lenders:

| Lender Name | Average Customer Rating | Loan Processing Time |

|---|---|---|

| FastFunds Bank | 4.8/5 | 24 hours |

| ClearView Financial | 4.6/5 | 48 hours |

| QuickCash Solutions | 4.5/5 | 36 hours |

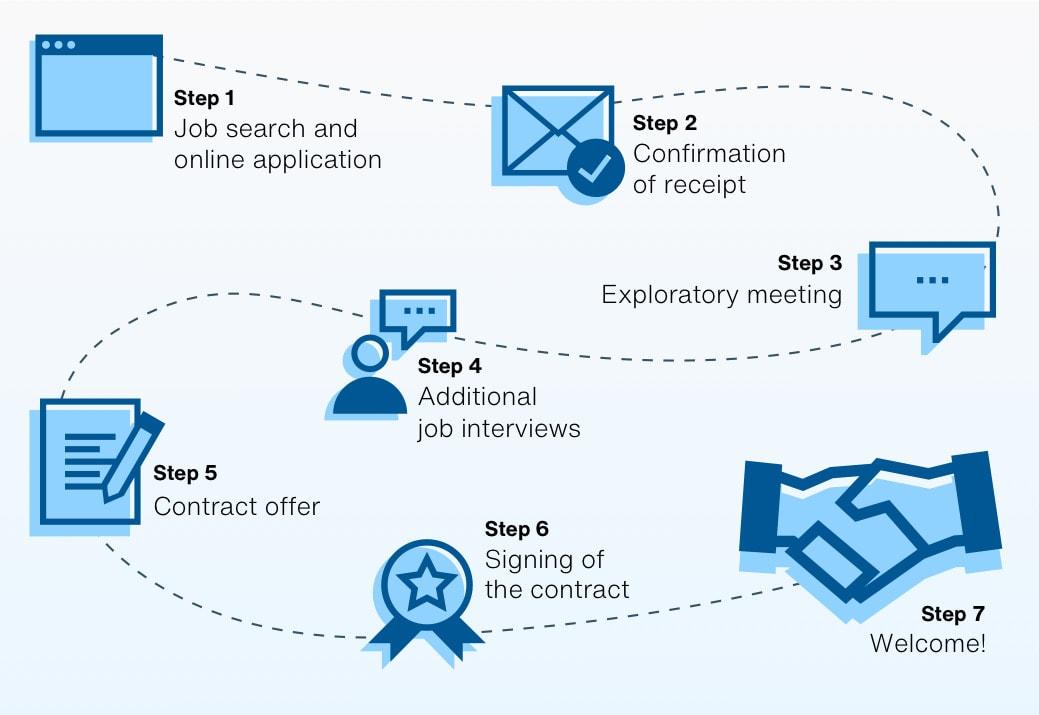

Navigating the Application Process for a Seamless Experience

Embarking on the journey to secure a low-interest personal loan can feel overwhelming, but understanding the application process is key to ensuring a smooth experience. Start by researching various lenders and comparing their loan products, interest rates, and eligibility criteria.Look for lenders that offer online applications, as these can often expedite the process. Create a checklist of required documents—such as identification, income verification, and credit history—to have everything at your fingertips when you decide to apply. This preparation will not only save time but will also help you present a complete application, which may improve your chances of approval.

Once you’ve selected a lender, fill out the application carefully, paying close attention to details—errors or inconsistencies can lead to delays. Many lenders provide tools that allow you to check your rate without affecting your credit score, so take advantage of these offers to gauge what you can expect. After submission, monitor your application status through the lender’s portal and be ready to respond to any requests for additional facts. Remember to review the loan terms thoroughly before acceptance, ensuring they align with your financial goals.

Tips for Maintaining a Good credit Score While Borrowing

When borrowing, it’s crucial to proactively manage your credit score, as it plays a significant role in securing the best loan terms. Start by reviewing your credit report regularly and ensure all information is accurate. If you find discrepancies, dispute them promptly. Additionally, maintaining a high credit utilization ratio is vital. Aim to keep your credit card balances below 30% of your total credit limit. Here are some effective strategies to consider:

- Make payments on time: Late payments can severely impact your credit score.

- Limit new credit inquiries: Too many applications within a short period can be detrimental.

- Diversify your credit types: A good mix of credit (installment loans and revolving credit) can positively influence your score.

another key factor in maintaining a healthy credit score while borrowing is managing your existing debts wisely. Consider the snowball method for paying off debts, which involves focusing on the smallest balance first. Alternatively, you could opt for the avalanche method, targeting debts with the highest interest rates. Either way,reducing overall debt levels contributes to a better credit standing. Here’s a simple comparison of these two methods:

| Method | Description | Best For |

|---|---|---|

| Snowball | Pay off smallest debts first to gain momentum. | Motivation and quick wins. |

| Avalanche | Pay off highest interest debts first to save money. | Long-term savings and efficiency. |

In Conclusion

As we draw the curtain on our exploration of the best low-interest personal loan lenders, it’s clear that the landscape of financing holds myriad opportunities for those seeking to make informed and responsible borrowing decisions. Your journey toward financial empowerment begins with knowledge—the kind that allows you to compare options, assess your unique needs, and select a lender that aligns with your goals.

Remember, the world of personal loans is as diverse as the individuals who inhabit it. Whether you’re aiming to consolidate debt, finance a significant purchase, or simply create a safety net, the right choice can significantly ease your financial path. Take the insights gleaned from this article as your compass,guiding you toward lenders who prioritize transparency and borrower satisfaction.

Before you step into this realm, take a moment to reflect on your financial habits, your credit standing, and your long-term aspirations. Armed with this understanding and the resources shared here, you are now poised to make a decision that could bring you closer to your financial dreams.

Explore, ask questions, and trust your instincts. The right low-interest personal loan is waiting to be discovered—one that can help you realize your plans while keeping your financial health in check. Happy borrowing!