In today’s fast-paced financial landscape, finding the right personal loan can feel like navigating a maze. Whether you’re aiming to consolidate debt, cover unexpected expenses, or fund a dream project, the interest rate you secure can significantly influence your overall costs. With countless lenders vying for your attention, it can be challenging to discern which options truly offer the best value. That’s where we come in. In this article, we’ll guide you through the top five personal loan lenders known for their competitive low-interest rates. Each choice on our list has been carefully evaluated to ensure you can make informed decisions that align with your financial goals. Let’s embark on this journey to help you borrow smarter and save more.

Understanding Personal Loans and Their Interest rates

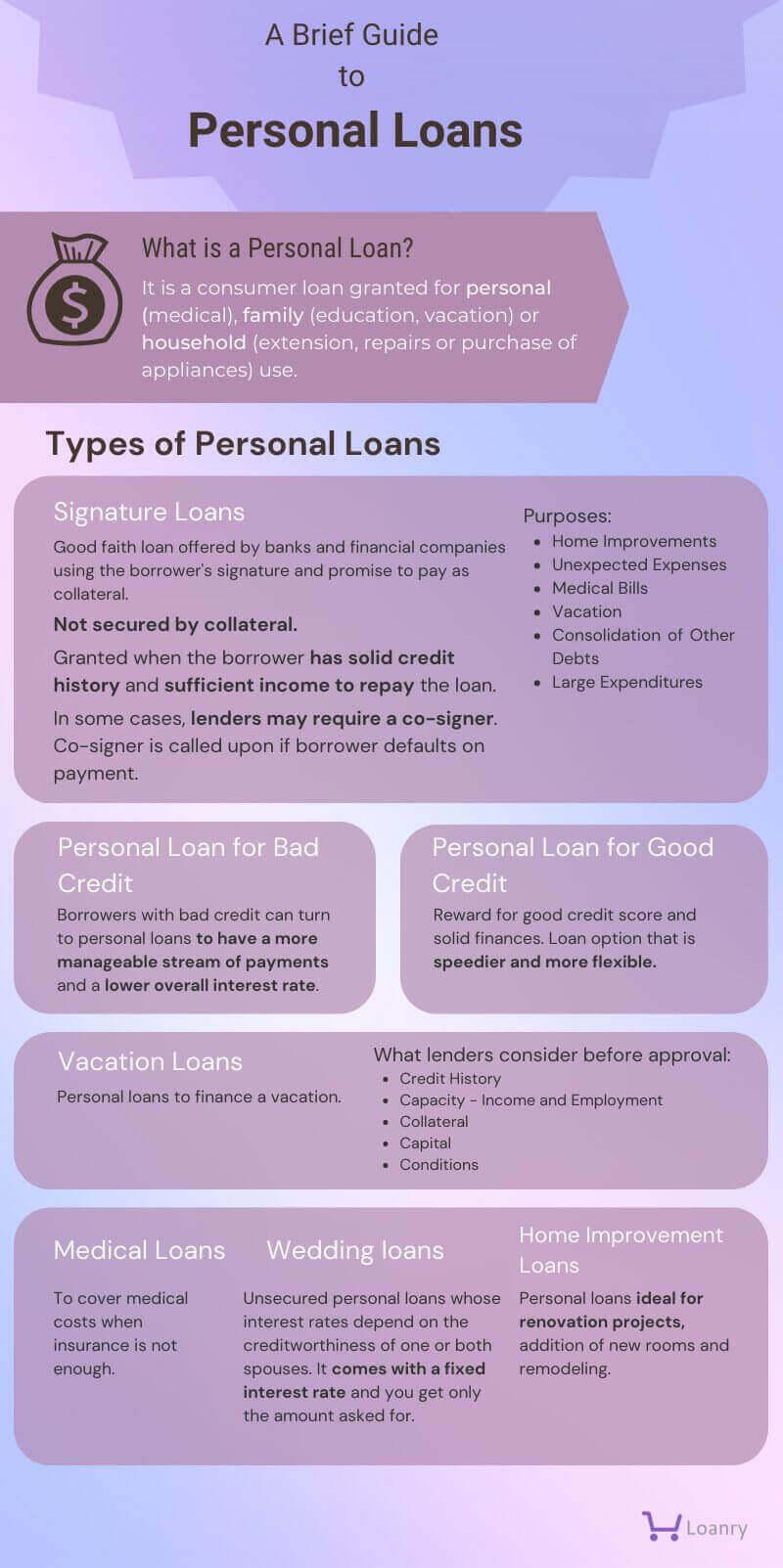

Personal loans are versatile financial instruments that allow borrowers to obtain funds for various purposes, such as debt consolidation, home improvements, or unexpected expenses. When considering a personal loan, one of the most critical factors to evaluate is the interest rate, as it directly influences the total cost of borrowing.Personal loan interest rates can vary significantly based on several criteria, including the borrower’s credit score, income, loan term, and prevailing market conditions. Typically, individuals with higher credit scores will be offered lower interest rates, which can lead to substantial savings over time.

It’s essential to understand the different types of interest rates associated with personal loans—primarily fixed and variable rates. A fixed interest rate remains constant throughout the life of the loan,providing stability in monthly payments,while a variable rate can fluctuate based on market changes,affecting future payments. When comparing lenders, borrowers should also pay attention to additional fees, such as origination charges or prepayment penalties, which can impact the overall loan cost. Evaluating these factors can help you make an informed decision when choosing a lender that best meets your financial needs.

Key Factors to Consider When Choosing a Lender

When selecting a lender for a personal loan, it’s vital to evaluate several key elements to ensure you are making the best financial decision.Start by examining interest rates, as these will directly impact your monthly payments and the total cost of the loan. Look for lenders that offer competitive rates and consider whether they provide fixed or variable rates.Also, don’t overlook the importance of fees such as origination fees, prepayment penalties, and late fees, as these can significantly affect the loan’s overall affordability.

In addition to rates and fees, assessing a lender’s customer service and reputation is crucial. Look for online reviews and testimonials to gauge customer satisfaction and responsiveness. Furthermore, consider the loan flexibility; check if the lender allows you to customize your repayment terms or offers options for altering your payment schedule in case of financial hardship. ensure that the lender’s application process is straightforward and transparent, providing you with all the necessary information without hidden surprises.

In-Depth Reviews of the leading Personal Loan Lenders

when exploring personal loan options, understanding the offerings of leading lenders can dramatically impact your financial journey. Some prominent names in the industry include SoFi, known for its competitive rates and flexible terms, and LendingClub, which stands out for its peer-to-peer lending model. Both lenders excel in catering to a diverse range of financial needs, making them strong contenders for those seeking low-interest rates.

Another noteworthy player is Marcus by Goldman Sachs, which offers no fees and an easy online application process. Their transparency and customer-friendly approach set them apart in a crowded field. Additionally, Discover personal Loans are favored for their reliable customer service and flexible payment options, enhancing the borrower experience. Lastly, LightStream is notable for its quick loan processing times and competitive rates, making them an excellent choice for those who need fast access to funds.

Comparing Interest Rates and Loan Terms

when evaluating personal loans, understanding the relationship between interest rates and loan terms is crucial for making an informed decision. Typically, lower interest rates can help borrowers save money over the life of the loan, but they can also come with specific requirements or shorter repayment periods. Conversely, loans with longer terms may offer lower monthly payments, yet potentially higher overall interest costs. To find the right balance, borrowers should consider factors like their monthly budget, future financial goals, and whether they prioritize low monthly payments or minimizing total interest paid.

Factors to consider while include:

- APRs vs. Interest Rates: Always compare the annual percentage rates (APR), which reflect the true cost of borrowing.

- Fixed vs. Variable Rates: Fixed rates provide stability, while variable rates may offer better initial terms but can fluctuate.

- Repayment Flexibility: Some lenders may offer flexible repayment options, which can be advantageous in times of financial uncertainty.

| Lender | Interest Rate | Loan Term |

|---|---|---|

| Lender A | 5.5% | 3-5 years |

| Lender B | 6.0% | 2-4 years |

| Lender C | 7.2% | 3-6 years |

Tips for Securing the Best rates from Lenders

To secure the most favorable rates from lenders, start by improving your credit score. A higher credit score signals to lenders that you are a responsible borrower, which can result in lower interest rates. Common strategies for enhancing your credit score include paying bills on time, reducing outstanding debts, and regularly checking your credit report for errors. Additionally, consider maintaining a low credit utilization ratio, ideally below 30%, to further boost your score.

Next, do your homework and shop around for the best options available. Compare offers from various lenders, including banks, credit unions, and online lenders. Don’t hesitate to negotiate – sometimes lenders are willing to lower their rates for competitive reasons. It’s also advisable to look for special promotions that may not be heavily advertised. Here are some essential tips to keep in mind:

- Understand your budget and how much you can afford to borrow.

- Check for additional fees that could affect the total cost of the loan.

- Consider loan terms; shorter terms usually come with lower interest rates.

- Utilize online calculators to estimate potential monthly payments.

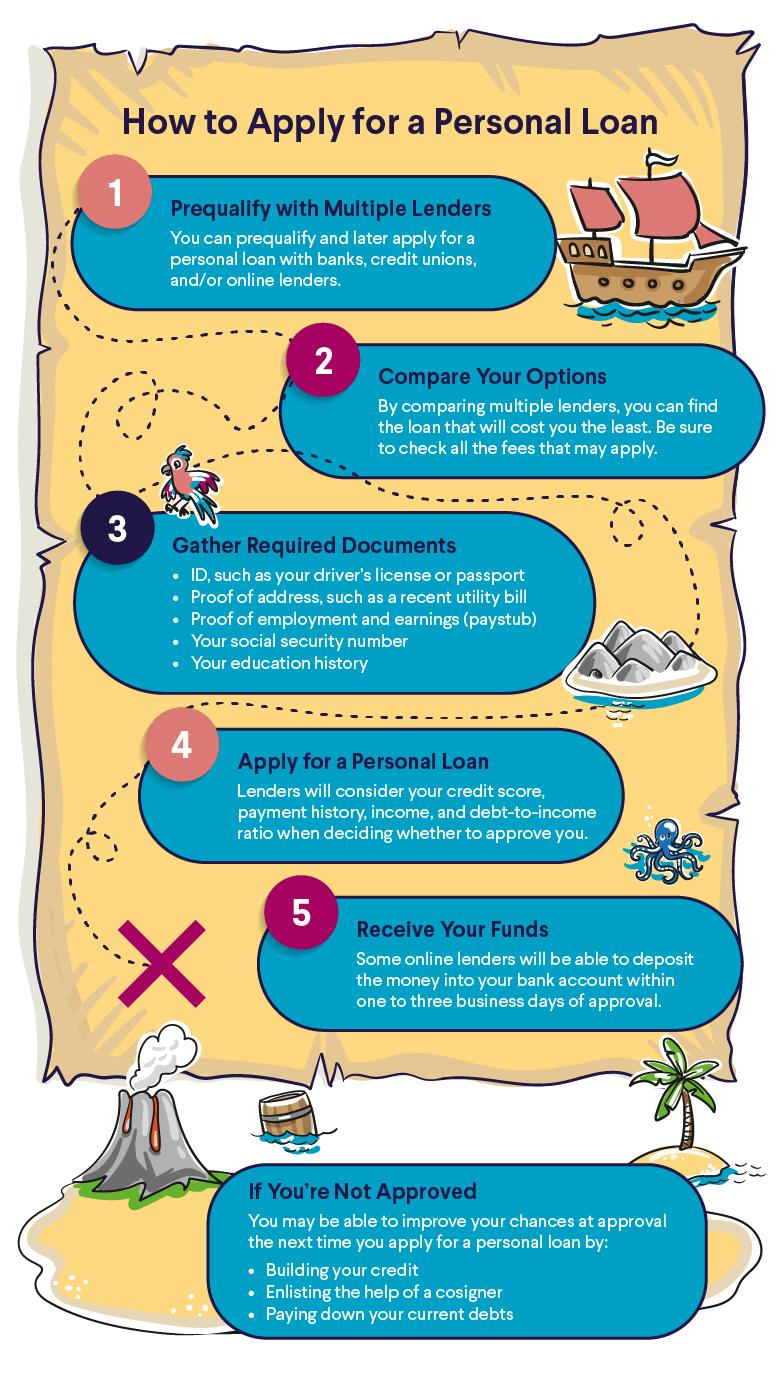

Navigating the Application Process for personal Loans

Embarking on the journey to secure a personal loan can often feel overwhelming, but understanding the application process can significantly ease your concerns. Start by evaluating your financial needs—determine how much you need to borrow, and for what purpose. Before diving into the application, it’s wise to check your credit score, as this will influence your eligibility and the interest rates you’ll be offered. Gather essential documents, such as proof of income, employment details, and any existing financial commitments. A well-prepared application can make a distinct difference in your approval chances.

While applying, it’s crucial to be aware of the key factors lenders typically evaluate, which include credit history, income stability, and debt-to-income ratio. Be transparent about your financial situation when completing the application; consider using an online loan calculator to help you understand potential repayments. Additionally, compare offers from multiple lenders to ensure you’re getting the best deal—this includes assessing not just interest rates, but also fees and terms. Here’s a concise comparison table of some top lenders to help simplify your choices:

| Lender | Interest Rate | Loan Amount Range | Repayment Terms |

|---|---|---|---|

| Credible | 3.99% – 35.99% | $1,000 – $100,000 | 3 to 7 years |

| LendingClub | 6.95% – 35.89% | $1,000 – $40,000 | 3 to 5 years |

| SoFi | 5.99% – 16.98% | $5,000 – $100,000 | 3 to 7 years |

| Upgrade | 5.94% – 35.97% | $1,000 - $50,000 | 3 to 5 years |

| LightStream | 3.99% – 19.99% | $5,000 - $100,000 | 2 to 12 years |

Key Takeaways

As we navigate the landscape of personal finance, securing a loan with a low interest rate can significantly ease the burden of borrowing. The top five personal loan lenders presented here not only offer competitive rates but also provide a variety of options tailored to meet the diverse needs of borrowers. Whether you’re planning to consolidate debt, fund a renovation, or manage unexpected expenses, these lenders stand out for their transparency, reliability, and customer service.

While choosing the right lender is an critically important step, it’s equally vital to assess your own financial situation and borrowing needs. as you embark on this journey, take the time to compare offers, read the fine print, and consider the long-term implications of your decision. With careful planning and the right information, you can turn your financial aspirations into reality without succumbing to overwhelming debt.

In this evolving financial landscape, the options are plentiful, and your path to achieving your goals is just a decision away. Happy borrowing!